In 2007 author and cultural provocateur Malcolm Gladwell presented a now famous Ted Talk on how stores offer dozens of brands and tastes of a commodity as simple as tomato sauce. Until the 1980s, there were only two major brands (Prego and Ragú), each of which sold a single, simple formulation and recipe. Gladwell claimed that he had counted 36 distinct Ragú spaghetti sauce varieties – cheese, garlic, mild, robusto, and extra chunky, among others.

Brands' strategy of securing maximum shelf space through such proliferation is now in full retreat, as firms increasingly focus on SKU (pronounced "skew") reduction. An SKU (stock keeping unit) is bar-coded information on all items that is particular to the color, style, and characteristics of each. SKUs, when scanned, give real-time data on sales and inventories.

SKU (stock keeping unit) is bar-coded information on all items that is particular to the color, style, and characteristics of each. SKUs, when scanned, give real-time data on sales and inventories.

Pandemic and supply chain difficulties have caused consumer-facing businesses to reconsider purchasing and carrying items that are sluggish sellers, less lucrative, and take up valuable warehouse and shelf space.

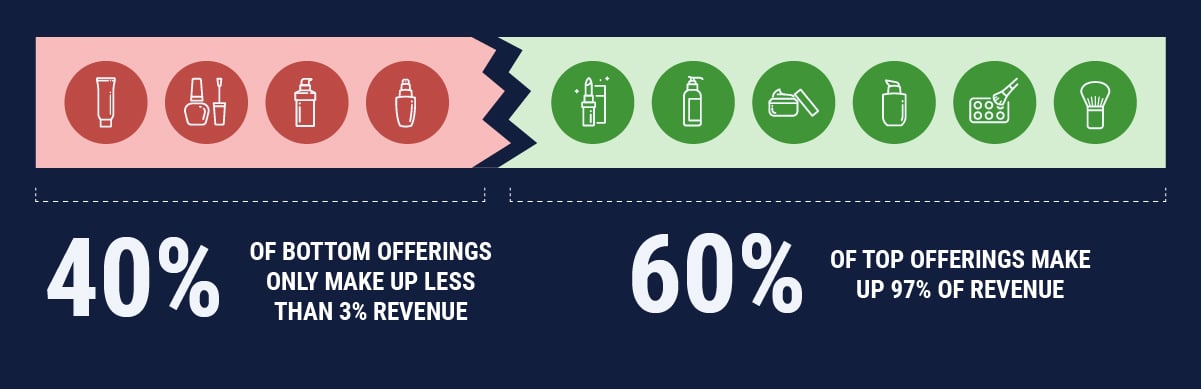

SKU rationalization isn't a new concept. A study published in the Harvard Business Review in 2006 by two supply chain specialists discovered that product proliferation reduces profit margins. According to the study, the bottom 40% of a company's items earned less than 3% of revenue, while the bottom 25% were severely unprofitable. Clorox, another corporation, saw 30% of its stock-keeping divisions fall short of sales volume and profit expectations. After the business implemented a procedure to detect trailing goods, retail sales per SKU increased by more than 25%.

Today, the technique is widely used, and SKU reduction can be found in many organizations' financial reports. HanesBrands was an early adopter, beginning to reduce its product offerings in 2000. Last February, CEO Steve Bratspies told analysts that Hanes has cut the number of its SKUs by more than 30%. It is unclear what impact the initiative has had on sales and profitability. However, the firm has produced results that have been above analysts' estimates in three of the last four quarters.

Hershey is a more recent entrant, announcing in April that pandemic-related challenges prompted the company to launch an SKU rationalization program that has "increased shelf space while freeing up capacity and reducing complexity." At the time, Hershey CFO Steve Voskuil told analysts, "We've been able to gain more (shelf) facings and sell more core products."

SKU proliferation is an inventory management and economic issue, but it may also be a barrier for consumers. The retail industry was already overstocked prior to the spring 2021 glut induced by late-arriving cargos from overseas. If you go to Home Depot or Lowe’s and hunt for a power wire, you'll find a bewildering array of combinations and designs.

Retailers like Walmart and Target are aggressively competing with Amazon by opening their platforms to third-party merchants. SKU proliferation in ecommerce has yet to be resolved. These days, you can purchase much of the same product that Amazon offers on their websites for approximately the same price, if not better. The judgment is yet out on whether this plethora of items is a net plus or bad in terms of converting consumers to customers.

One thing is certain: if you possess the inventory, you’d better be correct. Inventory investments are riskier with a high load of uncertainty in this unstable economic climate. One approach is to rationalize SKUs and choose more winners. It seems self-evident. The issue is determining which one will be the winner, especially in today's continuously changing, consumer-driven world. At the end of the day, ask your customer – they’ll tell you all you need to know.

First Insight’s InsightSelection utilizes real-time data analytics and customer feedback help retailers and brands optimize product assortments and identify winning products and design elements before costly investment decisions are made. Achieve better inventory assessments and wider profit margins with First Insight’s industry-leading retail assortment optimization software.