Buying or selling secondhand items is no longer the norm of only the very frugal. Brands and retailers are discovering that resale creates high-value social currency along with increased profit margins and new growth opportunities. With consumer demand increasing for recommerce, retailers can tap into this demand while building brand equity by supporting more sustainable operations.

Defining Recommerce

Recommerce is the practice of buying and selling used or secondhand goods. This is based on the idea of "reverse commerce" and "repeat commerce" where businesses and individuals can benefit from previously-owned goods instead of allowing them to end up in a landfill. It delivers on all three elements of the famous "Reduce - Reuse - Recycle" trifecta.

Recommerce can also include other sectors like restoring old buildings, taking one material and using it in another, or making new products out of old products. If you've ever bought gently used shoes, played on a playground with rubber mulch made from old tires, or carried a purse made from a pair of jeans you get the idea.

From thrift stores to high-end luxury boutiques, there’s a whole spectrum of companies that follow the resale model—and numerous digital marketplaces have taken this concept online. ThredUp, one of the most popular resale platforms, recently issued its 2022 Resale Report which estimates that “the global second-hand apparel market is expected to grow by 127% by 2026, more than three times faster than the global apparel market overall.” Other niche recommerce industries include home goods, collectibles, and art.

Types of Recommerce and Examples

Types of Recommerce and Examples

The apparel recommerce industry is composed of several different segments including:

|

Online businesses and subscription services |

|

|

Brand-operated resale Many luxury brands or companies with high-value products offer internal secondhand programs known as brand-operated recommerce. This model allows shoppers to purchase secondhand products directly from their favorite brands at a fraction of the cost. Companies like Trove are driving this industry forward by providing a seamless way to implement brand-operated recommerce. Examples: lululemon Like New, Apple Certified Refurbished, and Patagonia. |

|

Peer-to-peer marketplaces Recommerce also takes place from consumer to consumer. We've truly evolved the "garage sale" model by bringing this exchange of used goods online and into the 21st century. Examples: Mercari, Facebook Marketplace, eBay. |

|

Online businesses and subscription services |

Brand-operated resale Brand-operated resaleMany luxury brands or companies high-ticket price products offer internal secondhand programs known as brand-operated recommerce. Examples: lululemon Like New, Apple Certified Refurbished, and Patagonia. |

Peer-to-peer marketplaces Peer-to-peer marketplacesRecommerce also takes place from consumer to consumer as we evolved bringing the "garage sale" model online and into the 21st century. Examples: Mercari, Facebook Marketplace, eBay. |

While many businesses are making millions off this popular business model, the appeal of recommerce goes beyond money – it’s about recycling and repurposing while also improving sustainability in the fashion industry.

Patagonia's Worn Wear Program

Gen Z Fueling Resale Market

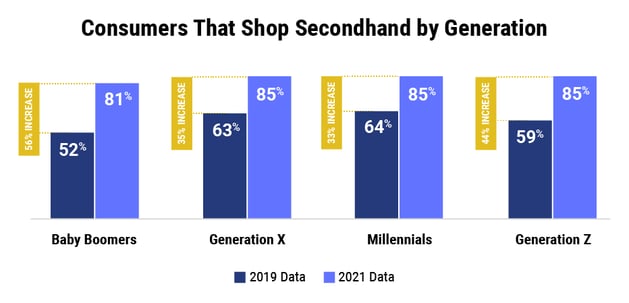

The primary driver of this cultural shift is Gen Z consumers, who place a higher value on sustainability than previous generations. They often shun new items—like apparel and accessories—because of the waste created by the fashion industry, from the drain of natural resources to the overproduction that ends up in landfills. While there has always been a market for used items—vintage stores, yard sales, thrift shops, and swap meets—today buying second-hand is seen as a virtue signaler and lifestyle choice. This trend shows no sign of abating. As more and more members of Gen Z join the workforce, their influence will continue to increase. In fact, Bank of America estimates their spending power will surpass that of Millennials by 2031.

Enormous opportunities exist for both retailers and brands to capitalize on the accelerating desire among consumers of all ages to buy and sell secondhand products.

Source: The State of Consumer Spending: Gen Z's Passion for Sustainability Boosts the Resale Market

U.S. Recommerce Trends and Consumer Research

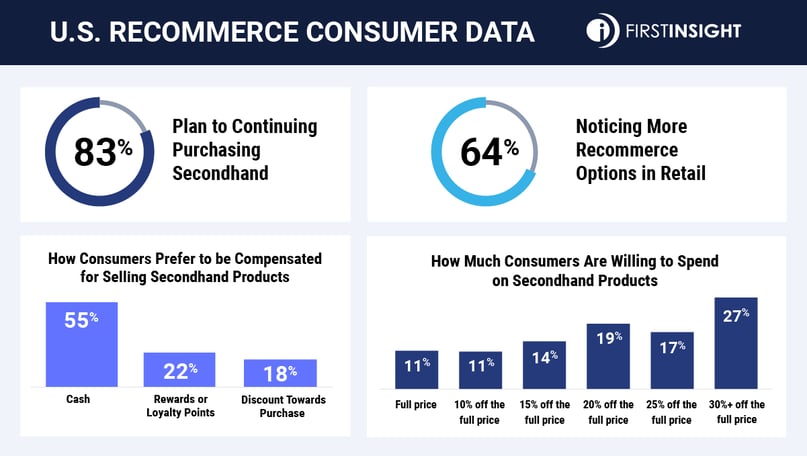

Sustainable shopping practices are becoming more prevalent across the US. First Insight and the Baker Retailing Center at the Wharton School of the University of Pennsylvania surveyed consumers on how sustainability impacts their shopping habits.

The study found that Gen Z has an outsized influence in persuading older generations to place a higher value on sustainability when it comes to their purchasing decisions. As a result, the popularity of recommerce has skyrocketed across all generations, with 83% of US consumers overall utilizing recommerce shopping formats. Even Boomers are 56% more likely to engage with recommerce—whether buying or selling—than they were just two years ago. Third party marketplaces, like ThredUp or The RealReal, are used more by Millennial and Gen Z consumers than other demographic cohorts.

Executive Recommerce Misperceptions:

Another survey conducted by First Insight and the Baker Retailing Center shows that retailers are largely unaware that consumers would prefer to shop directly with the brand or retailer’s own resale channels versus through a third-party platform. Retailers also assume that consumers must only want cash when selling previously worn items, when, in fact, consumers indicate that future discounts or increased loyalty points would also suffice.

Retailers were surprised to learn that price is not the greatest motivating factor for the majority of recommerce consumers. Sustainability, authenticity, and quality are all more important to consumers than retailers believe.

According to Upright Labs, analyzing Shopgoodwill, eBay, and Poshmark

According to Upright Labs, analyzing Shopgoodwill, eBay, and Poshmark

Luxury Recommerce

Even luxury brands are getting in on the recommerce trend. Some, like Balenciaga, are establishing their own resale channels with the help of Trove, resale startup Reflaunt, and others. Other brands, like Jimmy Choo, work with third party reseller The RealReal to make it easier for their customers to consign their products. In addition to being more sustainable, another reason for this change in attitude is that for many young luxury consumers, resale is their first point of entry. In fact, Boston Consulting Group revealed that 76% of female luxury shoppers buy vintage items when making their first luxury purchase.

Yes, used items often come with a somewhat lower price tag than new pieces. Many luxury purveyors deliberately limit inventory, especially on very popular items, making previously owned items the only readily available option for acquiring a coveted status symbol. Rolex, for instance, has years-long waiting lists for new steel sport watches. Hermès and Ferrari famously withhold their most popular items, only “allowing” very loyal consumers access to their brand. These rules go away in the secondary market, and, cleverly, serve to create a robust secondary market.

According to The RealReal Luxury Resale Report

Opportunity for the Market

The First Insight reports found that 76% of consumers in the US and 82% in the UK expect retailers to be more sustainable. Establishing a proprietary recommerce strategy can go a long way toward satisfying consumer demand while also serving as a vibrant new growth opportunity.

Understanding how to meet consumer demand is critical in today’s mission-driven environment. First Insight’s, InsightSUITE, which uses predictive analytics and voice of the customer data, can help brands embark on a path to greater sustainability and expanded consumer engagement for generations to come.