Hardly a day goes by without an article or discussion about "dynamic pricing." by now, weall know that dynamic pricing refers to the ability to present prices to specific consumers atcertain times based on their behavior, or in response to pricing actions undertaken by competitors. Today, it is primarily a tool for driving higher conversion rates for e-commerce sites.

Hardly a day goes by without an article or discussion about "dynamic pricing." by now, weall know that dynamic pricing refers to the ability to present prices to specific consumers atcertain times based on their behavior, or in response to pricing actions undertaken by competitors. Today, it is primarily a tool for driving higher conversion rates for e-commerce sites.

The ability to present specific offers and messages to individuals was foreshadowed in the 2002 Tom Cruise sci-fi thriller Minority Report. In the movie, technology enables the government to predict when an individual is about to commit a crime based on externally observed tendencies. Digital signs with facial recognition identify individuals and present them with targeted messages. The premise is that the application of a predictive model to observable behavior can accurately forecast future events.

Now some of this has become a reality. If you leave an item in your shopping cart, some online retailers will present you with a discount after a certain period of time. Technology can let retailers scan the web for competitor prices and reduce prices in nanoseconds in order to remain competitive.

The 2012 holiday season saw a dramatic increase in the use of dynamic pricing among leading online retailers. The New York Times reported that on the day before Thanksgiving. Amazon reduced its price on the Xbox game "Dance Central 3" to $49.96, the same as Walmart's price and three cents lower than Target. The next day, Best Buy offered the game at $24.99, and Amazon followed suit, Walmart responded by lowering its price to $15, and Amazon matched it. In the end, Amazon changed its price on the game seven times in one week. "The unluckiest buyer paid more than three times the price that the luckiest buyer paid," according to the Times article.

In the early days of retail (think "barter system"), dynamic pricing was the norm. Everything was negotiated, and each individual paid the price at which he or she valued the product, assuming the merchant was willing to sell it at the price. This is still the case in certain areas of our economy, such as street vendors and automobile dealers. Dynamic pricing has simply taken this process online: retailers can present a discount to someone who is getting ready to "walk away" (i.e. leave the website with a product in the shopping cart).

Dynamic pricing is an excellent vehicle for making real-time price adjustments in order to "get the price right, " causing an individual to pull the purchase trigger. But for all the attention being paid to dynamic pricing, over 90% of retail sales still occur in brick-and-mortar stores where this tool is impractical. A store cannot readily discriminate one consumer versus another while they are in the store. They can't (yet) tell whether a person has picked up a product, put it in their basket, and then put it back on the shelf. Most retailers also strive for price transparency, which means store and online prices are the same.

Manufacturers and retailers must pick a starting price point and promotional strategy, which matches demand and will maximize gross margin for the product within their assortment. This means that they need to know the percentage of the market that will buy the product at each price point, before they launch the product.

How can manufacturers and retailers set prices with intelligence in order to maximize margins? Many retailers with whom I interact have sophisticated systems to monitor sales of products once they hit the store shelves. They know who is buying, when and where they are buying, and at what price. Some that are highly sophisticated use loyalty programs and credit card data to present tailored price offers to specific individuals based on past purchase history.

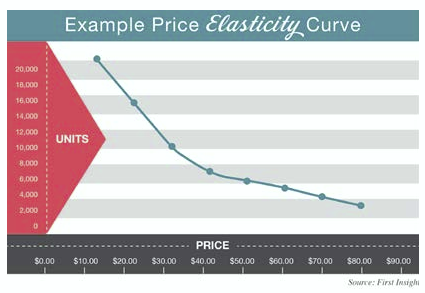

But with all the technology, when I ask them how they decide their entry or go-to-market price, many times the answer is: "we take the cost and apply our standard mark-up for the category." Those who strive to use market-based pricing may perform some market analysis and make an assessment as to where a product should be positioned given the competitive set. Ultimately, all companies want to know the price elasticity of a product before it is introduced. While this may sound like a complex term from a long-ago college economics class, price elasticity simply means the increase in demand, which will be generated by a decrease in price (or vice versa). It is essentially the price at which each segment of the market will buy the product. The chart is an example of a simple price elasticity curve for a product. Here you can see that reducing the price from $20.00 to $10.00 results in an increase in demand of approximately 5,000 units. However, reducing the price form $60.00 to $50.00 increases demand by only 1,000 units. It is clear that this product is more elastic at lower price points than at higher price points.

Each product has its own price elasticity curve. Some products share highly inelastic, such as cigarettes and gasoline. Increasing the price of either of these products does not reduce demand significantly. Products such as apparel, sporting goods, and yes, video games tend to be more elastic.

Every manufacturer and retailer can generate a price elasticity curve of each product after it has been in the market for a period of time. Most price systems will use this "historical elasticity" to set prices and determine markdowns for new, similar products. But the key is to gain an understanding of the price elasticity of a product that is new to the market, before it is launched, before any sales data is available. This can let retailers and brand set the right entry price point, moving beyond cost-based pricing into the world of value-based pricing. How does all this relate to dynamic pricing?

Ultimately, dynamic pricing in a necessary evil for most retailers. The reason Amazon, Walmart, Target and Best Buy engaged in the price war for the "Dance Central 3" game was that the product tis widely distributed and undifferentiated. This makes it highly elastic: the lowest price wins the sale.

Retailers are now caught in an arms race where they feel they need to promote products at the end of a quarter in order to show comp sales gains. As consumers catch on to dynamic pricing offers, retailers are simply training them to wait for a better deal. What happens next year when retailers need to anniversary these results?

There is a way out for retailers. First, understand your customer. Second, create unique, differentiated (read: inelastic) products that are exclusive to your channel. Third, price these products correctly from the start, with a forward view of consumer value.